7 First Time Home Buyer Programs to Know in Manitoba for 2025

Buying your first home in Manitoba is an exciting milestone, but navigating the financial side can feel overwhelming. With interest rates making headlines in the Winnipeg Free Press and discussions about housing affordability echoing across the province, it's easy to feel priced out of the market. The good news? A wealth of federal and provincial first time home buyer programs are designed specifically to help Manitobans turn their homeownership dreams into reality. These programs can significantly lower the barrier to entry, making that first purchase more achievable.

This comprehensive guide breaks down the essential programs available to you. We'll explore everything from tax-free savings accounts that accelerate your down payment goals to tax credits that put money back in your pocket after closing. You'll find practical examples relevant to buying in communities from Steinbach to Winnipeg, helping you build a clear, actionable financial strategy for your first home purchase. Let's get started.

1. The First Home Savings Account (FHSA): Your Tax-Free Down Payment Powerhouse

Launched in 2023, the First Home Savings Account (FHSA) has rapidly become the single most effective tool for Canadians saving for their first property. This registered plan combines the best attributes of an RRSP and a TFSA, making it a cornerstone of first time home buyer programs. Contributions are tax-deductible, reducing your annual taxable income, while withdrawals for a qualifying home purchase are completely tax-free.

This hybrid model accelerates your down payment savings in a way no other account can. Any major Canadian financial institution, including local options like Steinbach Credit Union or a national bank branch in Brandon, can help you open an FHSA.

How It Works in Manitoba

Imagine saving for a home in a growing community like Niverville, where the average single-family home price hovered around $420,000 in early 2024. You and your partner each open an FHSA and contribute the maximum $8,000 annually. If you're in a combined federal and provincial marginal tax bracket of 37.9%, this results in a direct tax refund of $3,032 each. You can then use that refund to pay down debt or even add it to next year's contribution.

In just three years, you could collectively save $48,000, plus any tax-free investment growth, positioning you with a solid down payment that avoids the higher CMHC insurance premiums.

Key Takeaway: The FHSA's tax deduction provides an immediate financial boost, while its tax-free growth and withdrawal features protect your hard-earned savings from taxes, helping you reach your down payment goal significantly faster.

Pros:

-

Dual Tax Advantage: Get a tax deduction for contributions and tax-free withdrawals for your home.

-

Flexibility: If your homeownership plans change, you can transfer the funds to your RRSP tax-free.

-

Stackable Savings: You can use funds from both your FHSA and the Home Buyers' Plan (HBP) for the same home purchase.

Cons:

-

Strict Limits: There's a firm $8,000 annual and $40,000 lifetime contribution limit.

-

Account Required: Contribution room only starts accumulating after you open an account.

-

Post-Withdrawal Timeline: The account must be closed within one year of your first qualifying withdrawal.

2. Canada Revenue Agency – Home Buyers’ Plan (HBP)

For decades before the FHSA, the Home Buyers' Plan (HBP) was the primary government-backed tool for tapping into your savings for a down payment. This long-standing program allows you to withdraw funds from your Registered Retirement Savings Plan (RRSP) to buy or build a qualifying home. As one of the most established first time home buyer programs, the CRA website provides the definitive guide on its rules and processes.

The website offers clear, step-by-step instructions on eligibility, withdrawal limits (recently increased to $60,000), and the crucial repayment process. It’s the official source for all required forms and explains exactly how the HBP can be used alongside other incentives like the FHSA.

How It Works in Manitoba

Consider a couple in Winnipeg looking to buy their first condo in Osborne Village. They have a combined $70,000 in their RRSPs. Through the HBP, they can each withdraw $35,000, giving them a substantial $70,000 tax-free loan for their down payment. Repayments start the second year after withdrawal and are spread over 15 years, requiring an annual repayment of about $2,333 each back into their RRSPs. This strategy can be especially powerful when you need to access a larger lump sum than the FHSA allows. You can see how this affects your monthly costs by using a Manitoba mortgage calculator.

Key Takeaway: The HBP functions as a tax-free loan from your own retirement savings, providing a significant boost to your down payment funds. The CRA's official page is the essential resource for navigating the rules and ensuring you remain compliant.

Pros:

-

Large Withdrawal Limit: Access up to $60,000 per person from your RRSP, for a potential $120,000 per couple.

-

Tax-Free Access: The withdrawal itself is not taxed as income, provided it's repaid on schedule.

-

Long-Standing Program: It is a well-established and widely understood program supported by all financial institutions.

Cons:

-

It's a Loan: You must repay the withdrawn amount to your RRSP over 15 years.

-

Tax Consequences: Any missed annual repayments are added to your taxable income for that year.

-

Lost Growth: The funds are no longer growing tax-deferred within your RRSP while they are withdrawn.

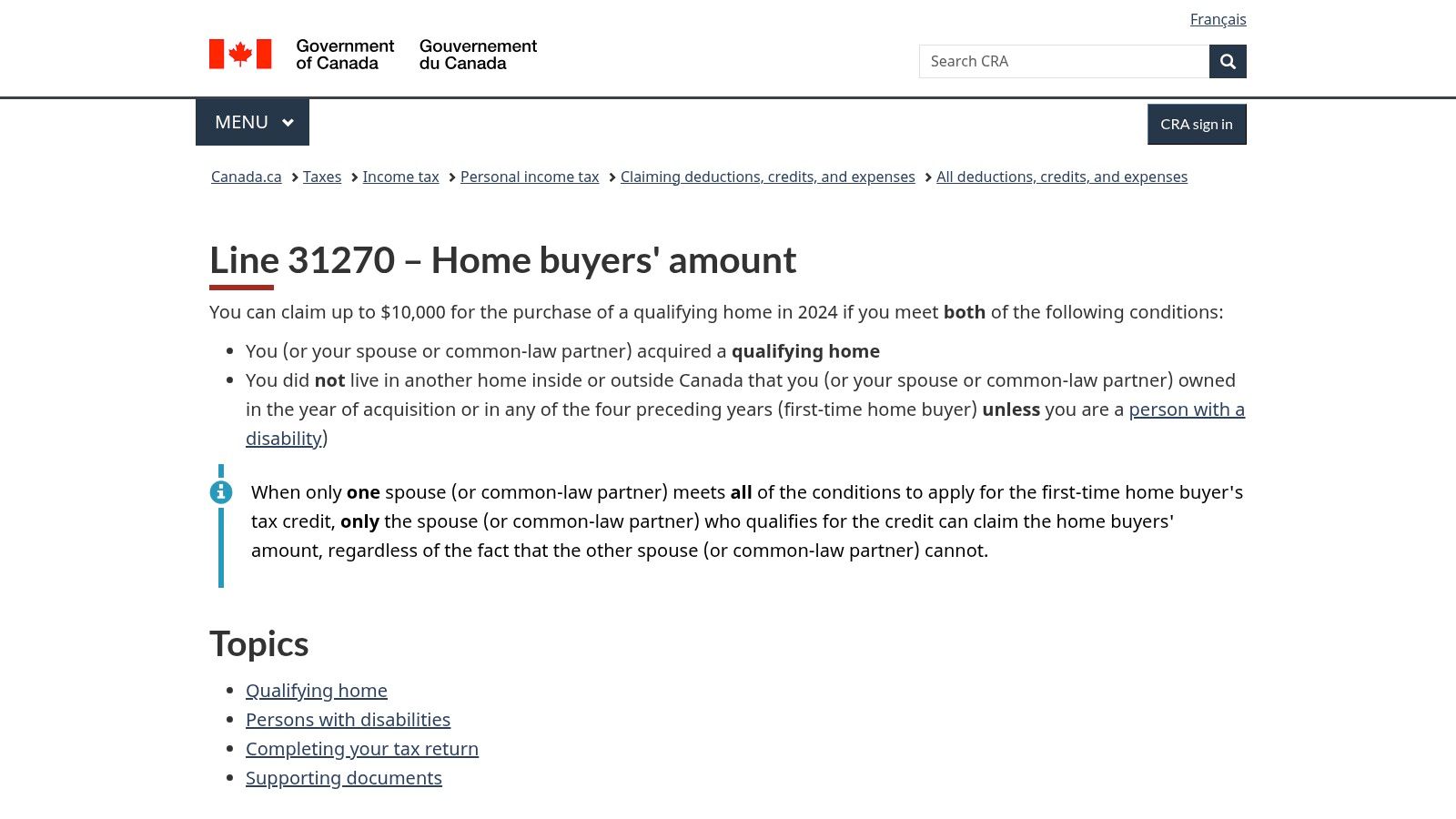

3. Canada Revenue Agency – Home Buyers’ Amount (First‑Time Home Buyers’ Tax Credit)

The Home Buyers’ Amount, often called the First-Time Home Buyers’ Tax Credit, is a straightforward but valuable component of federal first time home buyer programs. Accessible directly through the Canada Revenue Agency (CRA) website, this non-refundable tax credit helps offset the closing costs associated with purchasing a home, such as legal fees and the Manitoba Land Transfer Tax. The CRA provides clear, authoritative guidance on claiming this credit on your tax return.

The official CRA page is your definitive source for understanding eligibility and the claim process. It demystifies the tax jargon, ensuring you have the correct information directly from the government, which is crucial when filing your taxes after a major life event like buying a home.

How It Works in Manitoba

After purchasing your first home in a community like Lorette for $350,000, you'll face closing costs including a Land Transfer Tax of $4,720. When tax season arrives, you can claim the Home Buyers’ Amount on line 31270 of your federal tax return. For the 2023 tax year, this allows you to claim a $10,000 amount, which provides a federal tax credit of up to $1,500 ($10,000 multiplied by the lowest federal income tax rate of 15%).

While it’s not a large sum, this $1,500 tax reduction is a welcome bonus that can cover a good portion of your legal fees or replenish savings after paying for moving expenses. You or your spouse can claim the full amount, or you can split it between you.

Key Takeaway: The Home Buyers' Amount is a simple, effective way to get some money back from the government after your purchase. Use the CRA's official website to confirm eligibility and ensure you claim it correctly at tax time.

Pros:

-

Simple to Claim: It’s a single line on your tax return with clear instructions provided by the CRA.

-

Official Guidance: The website offers the most accurate and up-to-date information, eliminating guesswork.

-

Stacks with Other Programs: This credit can be claimed in addition to using your FHSA and the Home Buyers’ Plan.

Cons:

-

Non-Refundable: The credit only reduces your federal tax payable; if you owe no tax, you get no benefit.

-

Limited Financial Impact: The maximum benefit is a tax reduction of about $1,500, which is modest compared to other programs.

4. Department of Finance / CRA – First‑Time Home Buyers’ GST/HST Rebate

For those considering a brand-new build, the upcoming First‑Time Home Buyers’ GST/HST Rebate represents a significant potential cost-saving. The Canada Revenue Agency (CRA) website is the official source for this new measure, outlining how eligible buyers can receive a rebate on the GST paid for a newly constructed home. This makes it a crucial resource for anyone exploring the new-build market as part of their first time home buyer programs strategy.

The federal government's details are clear: the program provides a rebate of the 5% GST on new homes valued up to $1,000,000, with a phase-out for homes up to $1,500,000. It’s important to note this applies to purchase agreements signed on or after May 27, 2025.

How It Works in Manitoba

Imagine you're looking at a new home in a developing Winnipeg community like Sage Creek or a new subdivision in Steinbach. If the purchase price from the builder is $550,000, the 5% GST would be $27,500. Under this new program, an eligible first-time buyer could receive a full rebate for that $27,500, dramatically reducing the total purchase cost and the required mortgage amount. This is a game-changer for accessing the new-build market, where headlines often focus on rising material costs.

Key Takeaway: For buyers focused on newly constructed properties, this rebate offers a substantial, direct reduction in cost that is unmatched by other programs, making new homes more accessible.

Pros:

-

Significant Savings: Potentially the largest single upfront saving for eligible buyers of new homes, with rebates up to $50,000.

-

Clear Federal Guidance: The CRA website provides worked examples and clear definitions to help you understand your potential rebate.

-

Broad Eligibility: Includes newly built homes, owner-built properties, and shares in a co-op housing corporation.

Cons:

-

Limited Scope: Primarily applies to new construction and does not benefit buyers of existing resale homes.

-

Future Start Date: The program is for agreements entered into on or after May 27, 2025, and administrative details are still being finalized.

-

Application Process: Will require a formal application and processing through the CRA, adding an administrative step to the purchase.

5. Ontario Ministry of Finance – Land Transfer Tax Refunds for First‑Time Homebuyers

While this list focuses on Manitoba, it's crucial for homebuyers to understand that many valuable first time home buyer programs are province-specific. The Ontario Ministry of Finance website provides a perfect example, serving as the official hub for first-time buyers in Ontario to apply for a significant Land Transfer Tax (LTT) refund of up to $4,000. It offers a direct, no-nonsense portal for accessing this major cost-saving measure.

This resource is essential for anyone considering a move to Ontario, as it streamlines a process that can save you thousands at closing. The website lays out eligibility, provides all necessary forms, and clarifies how to claim the refund either at the time of registration or afterward.

How It Works for an Interprovincial Move

Imagine you're a first-time buyer from Steinbach, Manitoba, who just landed a job in Ottawa. You've found a starter home for $500,000. The provincial Land Transfer Tax would normally be $6,475. By using the forms and instructions on the Ministry's website, your lawyer can claim the maximum $4,000 refund on your behalf at closing. This reduces your immediate cash requirement to just $2,475 for the provincial LTT, a significant saving when closing costs are already high. This process is a key part of how you can make an offer on a house that wins in a competitive market.

Key Takeaway: For those moving to Ontario, this government website is the authoritative source for claiming a land transfer tax refund, directly reducing the upfront cash needed to close on your first home and making homeownership more accessible.

Pros:

-

Reduces Upfront Costs: The refund can be applied directly at registration, meaning you pay less out-of-pocket on closing day.

-

Official and Authoritative: All information, forms, and application portals are directly from the provincial government, ensuring accuracy.

-

Clear Guidance: The website clearly defines eligibility, such as not having previously owned a home anywhere in the world.

Cons:

-

Province-Specific: This program is only available for properties purchased in Ontario.

-

Refund Cap: The $4,000 maximum refund may not cover the full Land Transfer Tax on homes in more expensive markets like Toronto.

-

Strict Eligibility: You must meet all the government's criteria as a first-time buyer to qualify.

6. Province of British Columbia – Property Transfer Tax (PTT) Exemptions (First Time Home Buyers’ Program)

While focused on British Columbia, this official government website serves as an excellent resource for understanding how provincial tax relief can function as one of the most impactful first time home buyer programs. It centralizes all information on the Property Transfer Tax (PTT) exemption, providing a clear model of a significant cost-saving measure that, unfortunately, Manitoba currently lacks. Understanding how these programs work elsewhere can empower you to advocate for similar initiatives locally.

This platform provides up-to-date eligibility criteria, property value thresholds for full and partial exemptions, and direct links to all necessary forms. It’s a transparent, single source of truth for one of BC’s most valuable homeownership incentives.

How It Works (A BC Example)

Imagine you were buying a condo in Kelowna for $475,000. Under BC’s program, as a first-time buyer, you would qualify for a full exemption from the Property Transfer Tax, saving you $7,500 in closing costs. This is a direct, immediate saving that significantly lowers the barrier to entry. This contrasts with Manitoba, where a similar purchase in Winnipeg would incur a Land Transfer Tax of $7,220 with no first-time buyer exemption, a substantial added cost to budget for, as often highlighted in local real estate news.

Key Takeaway: While not directly applicable in Manitoba, this website is a valuable reference for what is possible with provincial tax relief programs. It highlights a significant potential area for policy improvement in Manitoba that could make homeownership more accessible.

Pros:

-

Centralized Information: A single, province-maintained source for all PTT relief programs.

-

Clarity and Transparency: Provides clear explanations and direct links to forms and detailed eligibility rules.

-

Model Program: Serves as a strong example of a high-impact provincial home buyer program.

Cons:

-

Not Applicable in Manitoba: This specific tax exemption does not exist for Manitoban buyers.

-

Variable Thresholds: Exemption amounts and property value limits can change, requiring buyers to confirm current rules close to their purchase date.

7. Revenu Québec – Home Buyers’ Tax Credit (Crédit d’impôt pour l’achat d’une première habitation)

While many first time home buyer programs are federal, Québec offers its own provincial tax credit to help residents with the costs of purchasing their first home. The official Revenu Québec website is the authoritative source for understanding the eligibility criteria, the maximum credit amount, and the exact steps needed to claim this valuable support on your provincial tax return. This platform is essential for any first-time buyer in Québec.

It provides clear, direct instructions and lists all qualifying dwelling types, from detached homes to co-op shares. Crucially, the site links directly to the specific form required, TP-752.HA-V, ensuring you have the correct documentation for a smooth tax filing process.

How It Works in Québec

Imagine you're buying your first condo in a neighbourhood like Griffintown, Montréal. After closing, you would visit the Revenu Québec site to confirm your eligibility and download form TP-752.HA-V. When you file your provincial taxes, you claim the specified credit amount, which directly reduces the amount of Québec tax you owe.

For 2023, the maximum credit provided a tax reduction of $1,500. While this may seem modest compared to a down payment, this amount can significantly help offset other closing costs like legal fees or the Québec land transfer tax (often called the "welcome tax"), freeing up cash for your immediate needs as a new homeowner.

Key Takeaway: The Revenu Québec website is the definitive resource for claiming the provincial home buyers' tax credit, providing a direct, non-repayable reduction of your Québec income tax liability and helping to ease the financial burden of associated purchasing costs.

Pros:

-

Official Source: Information comes directly from the provincial tax authority, ensuring accuracy and reliability.

-

Clear Documentation: The site provides explicit instructions and the specific form (TP-752.HA-V) required for the claim.

-

Broader Eligibility: Includes special provisions for individuals purchasing a home for a related person with a disability.

Cons:

-

Non-Refundable Credit: You only benefit if you have Québec provincial tax to pay; it won't result in a refund if you owe no tax.

-

Fixed Amount: The credit amount is capped and does not scale with the home's purchase price.

-

Province-Specific: This credit is only available to residents of Québec and applies only to their provincial tax return.

First-Time Homebuyer Programs — 7-Way Comparison

| Program | Implementation complexity | Resource requirements | Expected outcomes | Ideal use cases | Key advantages |

|---|---|---|---|---|---|

| Canada Revenue Agency – First Home Savings Account (FHSA) | Low–Moderate — open through a financial institution; rules on contribution room/carry‑forward | Regular contributions, access to FI, basic tax filing knowledge, use of CRA estimators | Tax‑advantaged down‑payment savings (tax‑deductible contributions; tax‑free qualifying withdrawals) | First‑time buyers saving for a down payment who want tax‑efficient growth | Authoritative CRA guidance, calculators, clear rules to avoid over‑contribution |

| Canada Revenue Agency – Home Buyers’ Plan (HBP) | Moderate — RRSP withdrawal process and ongoing repayment tracking | RRSP balance to withdraw, capacity to meet scheduled repayments, tax filing | Lump‑sum access to RRSP funds (up to $60,000 per eligible individual) with mandatory repayment obligations | Buyers with existing RRSP savings who prefer using retirement funds for a down payment | Access to substantial funds; clear CRA instructions and interaction guidance with other programs |

| Canada Revenue Agency – Home Buyers’ Amount (First‑Time Home Buyers’ Tax Credit) | Low — claim on tax return (line 31270) | Qualify as a first‑time buyer and complete tax filing | Non‑refundable tax credit recorded as the $10,000 home buyers’ amount (modest tax reduction) | First‑time buyers seeking a simple tax benefit at filing | Easy to claim, stacks with other federal/provincial programs |

| Department of Finance / CRA – First‑Time Home Buyers’ GST/HST Rebate | Moderate–High — eligibility and application rules for new/owner‑built homes; administrative rollout ongoing | Purchase of an eligible newly built/owner‑built home, documentation and application | Potential large upfront rebate (up to $50,000; full for homes ≤ $1,000,000; phased out to $1.5M) | Buyers of newly built or owner‑built homes meeting federal criteria | Potentially the largest single federal upfront savings; worked examples and federal guidance |

| Ontario Ministry of Finance – Land Transfer Tax Refunds for First‑Time Homebuyers | Low — online application or offset at registration | Proof of first‑time status, property details, online submission | Refund or offset of provincial land transfer tax (up to $4,000) | First‑time buyers purchasing in Ontario to reduce closing costs | Integrated with land registration to reduce upfront costs; official provincial instructions |

| Province of British Columbia – Property Transfer Tax (PTT) Exemptions | Low–Moderate — eligibility checks and forms for exemptions | Purchase in BC, documentation, confirm thresholds and applicable exemptions | Exemption or reduction of PTT (amounts depend on program and thresholds) | First‑time buyers in BC or purchasers of newly built homes eligible for exemptions | Centralized provincial guidance and direct links to forms and eligibility rules |

| Revenu Québec – Home Buyers’ Tax Credit | Low — claim via Quebec tax return using specified form | Documentation, complete Quebec return and TP‑752.HA‑V where required | Non‑refundable provincial credit (limited maximum amount per source) | First‑time buyers in Quebec or purchases for related persons with a disability | Provincial source tied to Quebec filing with explicit documentation and form guidance |

Putting It All Together: Your Next Steps with The Elias Group

Navigating the landscape of first time home buyer programs can feel overwhelming, but understanding these tools is the first step toward making your homeownership dream a reality in Manitoba. From leveraging the tax-free growth of the First Home Savings Account (FHSA) to withdrawing from your RRSP via the Home Buyers' Plan (HBP), the federal government offers powerful incentives to help you build your down payment faster.

The key takeaway is that these programs are not mutually exclusive. A strategic approach often involves stacking multiple benefits. For instance, you could combine withdrawals from your FHSA and HBP for a larger down payment on a new build in a growing Steinbach community. After closing, you can then claim the Home Buyers' Amount for a tax credit and potentially receive a GST/HST New Housing Rebate. This layered strategy maximizes your financial advantage and significantly lowers the barrier to entry.

However, the real power comes from applying these programs to your unique financial situation. Which combination is right for you? How do you ensure you meet every eligibility requirement? This is where professional guidance becomes invaluable. An experienced real estate team can help you connect the dots between saving for a home and actually finding one that fits your budget and lifestyle, whether it’s a modern condo in Sage Creek or a character home in Steinbach. They ensure you’re not just aware of the programs, but are using them to their fullest potential. Don't let uncertainty slow you down; take confident, informed steps toward your first home.

Ready to turn this knowledge into action? The journey to your first home is one of the most significant financial milestones you'll experience, and you don't have to navigate it alone. Contact The Elias Group today to create a personalized roadmap that leverages these first time home buyer programs and puts you on the fast track to getting the keys to your new home in Southeast Manitoba.

Categories

Recent Posts