How to Make an Offer on a House That Wins

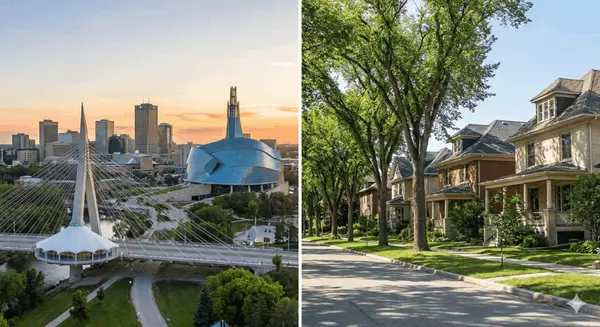

Making an offer on a house in Manitoba comes down to a few key things: getting your financing locked down, deciding on a smart, data-backed price, and including the right conditions to protect yourself. It's a strategic approach that makes sellers take you seriously, whether you're buying in the heart of Winnipeg or out in rural Southeast Manitoba.

Your Guide to a Winning Offer in Manitoba's Market

Making an offer on a house is so much more than just picking a number out of thin air. It’s a calculated move in a market that has its own unique rhythm, from the historic streets of Wolseley to the booming new communities in Niverville. Think of this guide as your personal playbook, breaking down the process into real, actionable steps so you can move forward with total confidence.

Let's dive into what makes an offer truly stand out here in Manitoba. We're talking solid financial backing, a price grounded in local data, smart conditions that give you an out if needed, and timing that puts you ahead of the competition. A winning offer is always built on a foundation of preparation and local market know-how.

The Anatomy of a Strong Offer

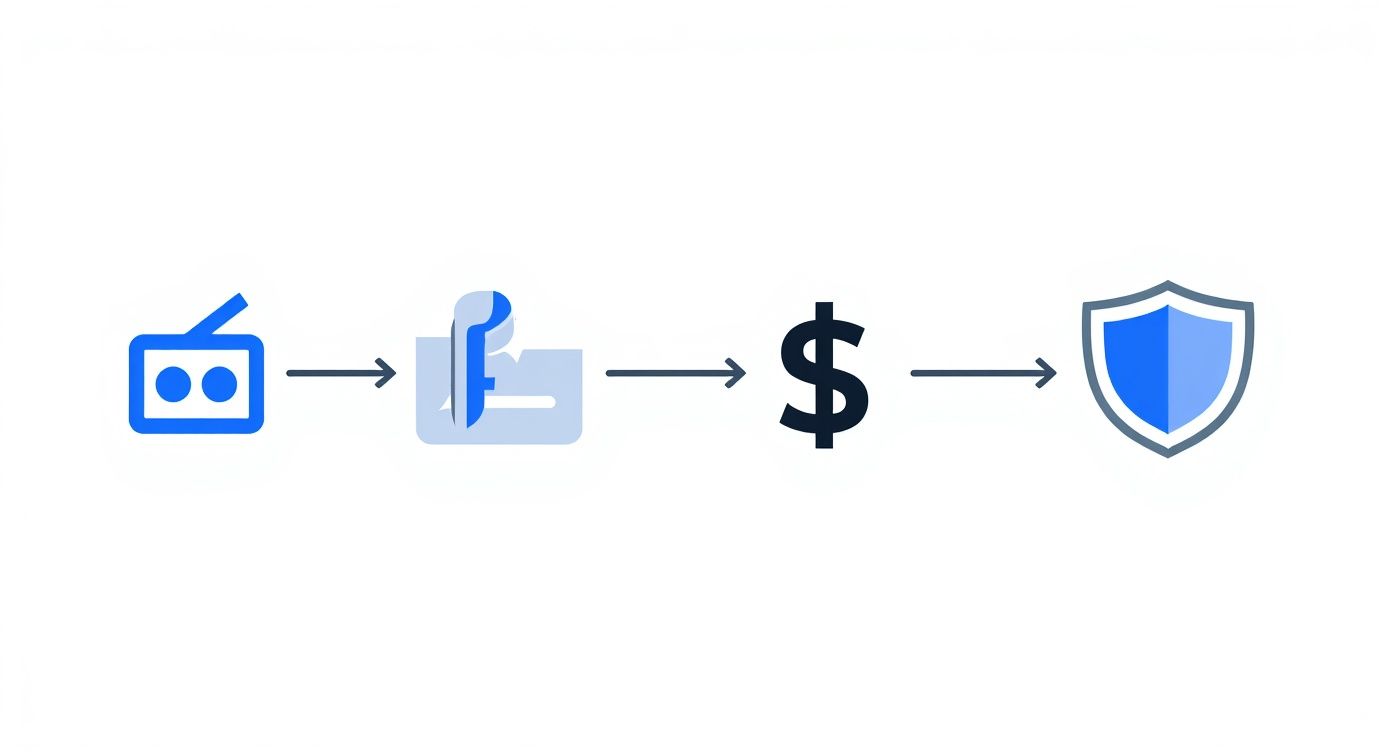

So, what does a successful offer really look like? It’s all about balancing three core pieces that work together to show a seller you’re serious, capable, and ready to get to the finish line.

-

Rock-Solid Financials: Before you even start scrolling through active Winnipeg, MB listings, getting your finances sorted is non-negotiable. A pre-approval letter from a Manitoba lender or Mortgage Broker, like a local credit union, often feels more concrete to sellers than one from a big, out-of-province bank. They know the local landscape and that carries weight.

-

A Strategic Price Point: Your offer price shouldn't be a wild guess. It needs to be a calculated figure based on what similar homes in the neighbourhood have recently sold for, how much demand there is right now, and the specific condition of the property. For example, if comparable homes in St. Vital have sold for 5% over asking in the past month, that data is crucial for your strategy.

-

Protective Conditions: These are your safety nets, plain and simple. Conditions for things like financing, a home inspection, or even the sale of your current home are standard practice and protect you from nasty surprises.

This infographic breaks down the essential flow of putting together that winning offer, from getting your money ready to including the right protections.

As you can see, these three pillars—finances, price, and conditions—are all connected and really form the backbone of your offer. Each section of this guide will build on this framework, giving you the clarity you need to make a successful purchase.

Preparing Your Finances Before You Make an Offer

Long before you fall in love with a house and start picturing where your furniture will go, the most successful offers begin with a rock-solid financial game plan. Getting your finances in order isn't just a box to check; it’s your single greatest advantage in a competitive market. It tells sellers you’re serious, capable, and ready to close the deal without any last-minute drama.

The absolute cornerstone of this plan is getting a mortgage pre-approval. This is much more than just playing with an online mortgage calculator. A pre-approval is a formal letter from a lender confirming they’re willing to loan you a specific amount of money. It’s tangible proof you have the funds to back up your offer.

Here in Manitoba, we've seen time and again that sellers give more weight to pre-approvals from local lenders or well-regarded mortgage brokers. They know the local market inside and out and have a reputation for getting deals done smoothly. At The Elias Group, we always connect our clients with these trusted local experts who often secure better rates and more flexible options than the big national banks can offer.

Assemble Your Expert Team

Knowing how to make an offer on a house also means having the right people in your corner from day one. A winning offer is backed by a team that can act fast.

-

A Local Mortgage Broker: They’ll do the heavy lifting for you, shopping around to find the best possible mortgage product for your specific situation. This alone can save you a ton of time and money.

-

A Real Estate Lawyer: Your lawyer is essential for handling the title search, reviewing all the legal paperwork, and making sure the property ownership is transferred to you without a hitch.

-

A Certified Home Inspector: Their expertise is your protection against costly surprises down the road. They uncover the potential issues you can’t see during a showing.

Having this dream team lined up before you even find "the one" means you can move decisively, making your offer that much more attractive to a seller.

A strong pre-approval can be the deciding factor. We recently helped a client in St. James secure their dream home, even though their offer was slightly lower than a competing one. The seller chose our client's offer because their financing was firmly pre-approved by a local credit union, while the other offer had shakier, unverified financing.

Plan for Your Down Payment and Closing Costs

Beyond the price of the house itself, you need cash ready for two other major expenses: your down payment and closing costs. Forgetting to budget for these can create a huge amount of stress right when you should be celebrating.

Your down payment is a percentage of the home’s purchase price, and the minimum amount in Canada depends on how much the home costs.

Closing costs are a separate bucket of fees you’ll pay on or before the closing date. They typically add up to 1.5% to 4% of the home's purchase price and cover things like legal fees, land transfer tax, and appraisal fees. For a closer look, check out our guide on how to prepare yourself to purchase a home in Manitoba.

How to Determine Your Offer Price and Deposit

Okay, you’ve got your financing lined up—now for the exciting part. We need to talk numbers, specifically the most important one in your offer: the price. Figuring out what to offer isn’t about pulling a number out of thin air or letting emotions take over. It’s a strategic move, grounded in solid data and a real feel for the local market.

This is where we shift from prep work to putting a plan into action. Our goal is to craft a number that’s competitive enough to get the seller’s attention but smart enough that you’re not overpaying. We’re looking for the property's true market value, and that's the same whether you're eyeing a sprawling home in Tuxedo or a cozy starter in Transcona.

Analyzing the 'Comps' for a Data-Driven Price

To get to that magic number, we dive into what’s called a Comparative Market Analysis (CMA). This is way more than just a quick online search. It’s a deep dive into "comps"—shorthand for comparable, recently sold properties right in the neighbourhood. A professional CMA gives you the hard data you need to make an offer with total confidence.

Here’s what we look at to build your pricing strategy:

-

Recent Sale Prices: This is our north star. We look at what similar homes on nearby streets have actually sold for in the last few months.

-

Days on Market (DOM): How long did those other homes take to sell? If they flew off the market in a week, we know it's hot and offers need to be strong. If they sat for a month, there might be more wiggle room.

-

Property Condition and Features: We stack up the house you love against the comps. Does it have a renovated kitchen? A finished basement? These upgrades add real value that has to be factored in.

-

List Price vs. Sale Price Ratio: Are homes in the area selling for asking, above it, or below? This little ratio tells a huge story about how much demand there is in that specific pocket of the city.

Let’s say a home in Steinbach is listed at $399,900. If we see three similar houses on the next block over sold for between $410,000 and $415,000 in the last month—and they all sold within a week—that sends a pretty clear message. Just offering the list price probably isn't going to cut it.

Understanding the Role of Your Deposit

The offer price is what you ultimately pay, but the deposit is what shows you mean business right now. Think of it as "good faith" money you put down with your offer. It gets held in a trust account and then goes toward your down payment when the deal closes.

In Manitoba, a typical deposit is anywhere from 1% to 5% of the purchase price. On a $400,000 home, that’s between $4,000 and $20,000. While a seller might accept a smaller deposit, a larger one makes your offer look much stronger, especially if you end up in a bidding war. It tells the seller you’re financially solid and ready to go.

A strong deposit tells the seller you're not just window shopping—you're a serious buyer with the financial capacity to see the deal through. It can be a powerful psychological tool in negotiations.

Sample Offer Price Scenarios in Winnipeg

Market conditions can change in a heartbeat, and your strategy has to change with them. To give you a better idea, here’s a look at how you might approach an offer for a home listed at $450,000 in Winnipeg under different circumstances.

| Market Condition | Offer Strategy | Potential Offer Price | Rationale |

|---|---|---|---|

| Hot Seller's Market | Aggressive, likely above asking | $465,000 - $475,000 | Multiple offers are expected. A strong, clean offer above list price is often necessary to stand out and win. |

| Balanced Market | Strategic, close to asking | $445,000 - $450,000 | There's a healthy balance of buyers and sellers. An offer near the list price is competitive but still allows for negotiation. |

| Cool Buyer's Market | Conservative, potential for below asking | $430,000 - $440,000 | Homes are staying on the market longer. Buyers have more leverage, so a lower offer with conditions is a reasonable starting point. |

As you can see, there’s no one-size-fits-all answer. It’s all about reading the room—or in this case, the market—and positioning your offer to succeed.

Crafting Your Offer with Confidence

With a solid CMA in your hands and a clear plan for your deposit, you’re ready. We'll put all the pieces together to decide on an offer price that makes sense. It’s about more than just the final number; it’s about presenting a complete, compelling package to the seller.

Your offer needs to reflect what the market data says the home is truly worth. To get a handle on how different offer prices and down payments will impact your monthly budget, I always recommend playing around with our user-friendly mortgage calculator. It helps ground your offer in both market reality and your own financial comfort zone, giving you the confidence to move forward.

Using Conditions to Protect Your Purchase

When you’re writing an offer, the price always seems to get the spotlight. But from my experience, the conditions are your most powerful tools. Think of them as your legal safety nets woven right into the contract. They give you a clean, ethical exit strategy if something unexpected and serious pops up, letting you walk away with your deposit safe and sound.

Crafting the right conditions is a bit of an art form. You need to protect yourself without making your offer look weak or overly complicated to a seller, which is especially important when you’re up against other buyers. Let’s break down the most critical conditions you’ll want to consider for your Manitoba home purchase.

The Big Three Conditions for Buyers

In most situations, there are three core conditions that do the heavy lifting. These are the ones we almost always recommend including because they shield you from the biggest potential risks you'll face.

-

The Financing Condition: Unless you're paying with a suitcase full of cash, this one is non-negotiable. This clause makes your offer conditional on you securing a mortgage you’re happy with. It usually gives you 5-7 business days to get that final, formal approval from your lender. If the bank backs out for any reason, so can you.

-

The Home Inspection Condition: This gives you the right to bring in a professional home inspector to really get to know the property. If the inspection uncovers major issues you couldn't see—we're talking a cracked foundation, mould hiding in the attic, or a roof on its last legs—you can either walk away or head back to the negotiating table.

-

The Sale of Buyer's Property Condition: This one is absolutely vital if you need the proceeds from your current home to buy the next one. It simply states that your offer is only firm once your existing place sells. It's a critical safety net, but be aware that it can make your offer less appealing to sellers who are looking for a sure thing.

These three conditions tackle the most common and costly hurdles in a real estate deal. They ensure you're not getting locked into a purchase you can't afford or one that comes with a nightmare of hidden repair bills.

A Real-World Example From Rural Manitoba

Let me share a quick story that shows why these conditions are so important. We were working with a wonderful family who fell head over heels for an acreage in La Broquerie. It had all the charm they dreamed of, but during the inspection, we discovered major issues with the installation of the metal roof.

The repair quote came in at over $50,000. Because we had a solid home inspection condition in place, they were able to terminate the offer and get their entire deposit back. They were disappointed, of course, but incredibly relieved to have dodged a financial bullet. That's the power of a well-written condition.

"A condition isn't a sign of a weak offer; it's a sign of a smart buyer. It ensures you're making a confident and informed decision, not a desperate one."

Other Important Conditions to Consider

While the "big three" cover most bases, other situations call for different protections. Here are a few more you might run into:

-

Review of Condominium Documents: If you're buying a condo, this is a must-have. It gives you and your lawyer time to dig into the condo corporation’s financial health, by-laws, and reserve fund study. You want to make sure the building is well-managed and not about to hit you with a massive special assessment.

-

Confirmation of Insurability: Sometimes, a home’s history—like old claims for knob-and-tube wiring or water damage—can make it tough or wildly expensive to insure. This condition gives you a window to confirm you can get affordable home insurance before the deal is final.

-

Water Potability and Septic System Approval: For rural properties in areas like Southeast Manitoba, these are standard procedure. You need to verify that the well water is safe to drink and the septic system is in good working order.

Navigating Counter-Offers and Closing the Deal

Getting your offer in is a huge step, but honestly, it’s often just the start of the real conversation. The next phase—negotiation—is where a good agent can turn a decent deal into a fantastic one. My advice? Stay calm, lean on our experience, and remember that nearly everything is on the table, not just the price.

Sellers have three ways to respond to your offer: they can accept it as is (the dream!), reject it outright, or the most common path: they send back a counter-offer. A counter-offer is just their proposed list of changes. They might ask for a higher price, a different closing date, or decide they want to take the fancy dining room light fixture with them.

It’s so important not to take a counter-offer personally. It’s a completely normal part of buying a house and a great sign that the seller is serious about working with you. From there, we’ll review their changes together and figure out our next move.

Handling Counter-Offers and Bidding Wars

Upon receiving a counteroffer, you can accept the new terms or walk away.

In a hot market, which we've definitely seen in many Winnipeg neighbourhoods lately, you could find yourself in a multiple-offer situation—what most people call a bidding war. This is where it’s absolutely critical to stay objective. It’s so easy to get swept up in the emotion of "winning" the house, but that's how people end up overpaying. We need to stick to the maximum price we already decided on based on your pre-approval and what the market data says the home is worth.

Here are a few strategies we use to navigate these scenarios:

-

Respond Promptly: We don’t want to leave the seller hanging. A quick, thoughtful response shows you’re motivated and ready to go.

-

Check Every Detail: A counter isn't always about the dollar amount. Did they change the possession date? Did they suddenly exclude the washer and dryer you were expecting? We’ll comb through it.

The Power of Negotiating Beyond Price

Sometimes, the most valuable wins in a negotiation have nothing to do with the final price. Things like possession dates, included appliances (chattels), or even how long you have to get your financing in order can be powerful bargaining chips.

From Accepted Offer to Getting the Keys

Once you and the seller have signed a final, accepted offer, the real work begins to check off all your conditions. You're in the home stretch now!

-

Satisfy Your Conditions: This is when you officially get things done. You'll send the final paperwork to your lender to secure the mortgage, we’ll bring in the home inspector, and your lawyer will review the condo documents if applicable. All of this has to be done within the timeframe we negotiated in the offer.

-

Signing with Your Lawyer: A week or two before you get the keys, you'll meet with your real estate lawyer. They’ll walk you through all the final paperwork, like the title transfer and mortgage documents. This is also when you'll hand over the rest of your down payment and closing costs.

On possession day, your lawyer gives you the green light once the funds have been transferred and the title is officially in your name. After that, I get to make my favourite call—the one telling you it’s time to go pick up the keys to your new home.

Common Mistakes to Avoid When Making an Offer

Learning from other people's mistakes is one of the fastest ways to get ahead in real estate. After guiding hundreds of families through this process, we’ve seen the same handful of preventable errors sink an otherwise solid offer. This is all about giving you the foresight to make smart, confident decisions when it really counts.

The journey of making an offer on a house is exciting, but that emotion can sometimes lead you astray. Let’s look at the most common pitfalls and, more importantly, how to sidestep them completely.

Letting Emotions Drive the Bus

It’s so easy to fall in love with a home. You start picturing your future within its walls, imagining holiday dinners and summer evenings on the patio. The danger comes when that emotional attachment clouds your judgment, especially in a bidding war. That’s when buyers overpay, ignore red flags, or give up protections they later regret.

The Solution: Stick to the plan we made together. Before you even think about writing an offer, we've already established a maximum price based on hard data from the Comparative Market Analysis (CMA) and your mortgage pre-approval. Your budget is your anchor; don't let the heat of the moment convince you to cut it loose.

Skipping the Home Inspection

In a hot market, some buyers get tempted to waive the home inspection to make their offer more attractive to sellers. This is, without a doubt, one of the riskiest moves you can possibly make. You’re essentially agreeing to buy the property "as is," which includes any hidden, expensive problems lurking beneath the surface.

A recent news report from CTV Winnipeg highlighted how some Manitoba buyers felt pressured into skipping inspections during the market frenzy, only to discover costly issues later. This just shows how big of a gamble it is.

In a busy seller's market, you can get the inspection prior to the offers date so that you can avoid costly repairs. Think of it this way: the cost of an inspection—usually a few hundred dollars—is a tiny investment for the peace of mind it buys. It can uncover tens of thousands of dollars in potential repairs, from a failing furnace to a leaky foundation. It's a small price to pay for certainty.

Not Reading the Fine Print

An Offer to Purchase is a legally binding contract. Every single line in that document matters, from the possession date to the list of included appliances (we call these chattels). A common mistake is just skimming it and assuming everything is standard.

Did the seller exclude the high-end washer and dryer you thought were staying? Is the closing date actually aligned with your moving timeline? These little details can become big headaches.

The Solution: We review every single clause of the offer and any counter-offers together, line by line. My job is to point out any changes, additions, or things that are missing and explain exactly what they mean for you. Never, ever sign anything until you are 100% clear on what you are agreeing to.

By avoiding these common mistakes, you protect your financial well-being and make sure the path to your new home is as smooth as possible. You're not just buying a property; you're making one of the biggest investments of your life. Let's make sure we do it right.

Navigating the complexities of making an offer requires a steady hand and local expertise. At The Elias Group, we provide the clear, step-by-step guidance you need to buy with confidence and avoid costly pitfalls. Start your journey with us today.

Categories

Recent Posts