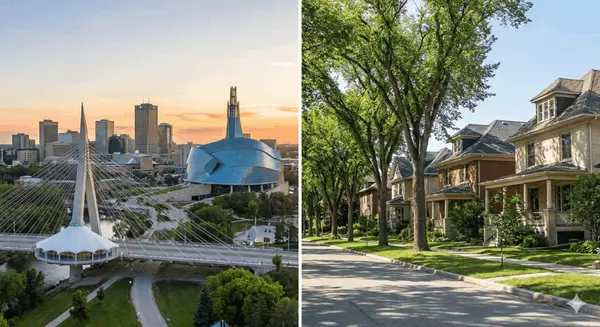

What Is Home Equity in Manitoba?

When you hear the term “home equity,” it’s easy to get lost in financial jargon. But the concept is actually pretty simple. Think of your home equity as the portion of your property that you truly own.

It's the straightforward difference between what your home is worth on the market today and whatever you still have left to pay on your mortgage. In many ways, it’s a hidden savings account that grows quietly in the background as you make your monthly payments and as your home’s value climbs over time. For most Manitobans, it becomes one of their most significant wealth-building tools.

Your Home's Built-In Savings Account

Many Manitobans see their home as just a place to live, but it's so much more than that. It’s a dynamic financial asset that builds your net worth, often without you having to lift a finger. Getting a handle on what home equity is and how it works is the first real step toward making smarter financial decisions for your future.

At its core, your equity is your financial stake in your own property. It's the part that belongs to you, not the bank. The best part? This value isn't static; it changes and, in a healthy market, grows significantly over the years.

Let's break down the basics of home equity in this quick table.

Home Equity at a Glance

| Component | Simple Explanation | How It Grows |

|---|---|---|

| Market Value | What a buyer would likely pay for your home today. | Rises with local demand and property improvements. |

| Mortgage Balance | The amount you still owe to your lender. | Decreases with every mortgage payment you make. |

| Home Equity | Your ownership stake (Market Value - Mortgage Balance). | Grows as your mortgage shrinks and your home's value rises. |

As you can see, the path to building equity is a combination of your own financial discipline and the strength of the local real estate market.

The Two Engines of Equity Growth

So, how does this "savings account" actually get bigger? Your home equity grows in two primary ways, and understanding these two forces is essential for any homeowner in markets like Winnipeg, Steinbach, or Brandon.

-

Paying Down Your Mortgage: Every single mortgage payment you make is split into two parts—interest and principal. That principal portion directly chips away at what you owe, which in turn increases your ownership stake. It’s a slow and steady process, but it builds a rock-solid foundation.

-

Market Appreciation: This is where things get really exciting. As the value of real estate in your area goes up, so does your home's worth. Recent reports from the Winnipeg Regional Real Estate Board have shown consistent appreciation across many neighbourhoods. Just look at the recent news—headlines from the Winnipeg Free Press often highlight how areas like Sage Creek and Transcona are seeing strong demand, which directly boosts the value of homes there. This means your equity can grow even when you’re not making extra payments.

This dual-engine growth is exactly why homeownership is such a powerful tool for long-term financial stability. You're actively paying down a debt while the asset itself is likely increasing in value.

A rising real estate market acts as a powerful tailwind for homeowners. For example, a modest 3% annual increase in value on a $400,000 home in a stable community like Niverville adds $12,000 to your equity in just one year, on top of what you’ve paid down on your mortgage.

Why Equity Matters in Manitoba

In a dynamic market like Manitoba, having substantial home equity gives you options. It can act as a financial cushion for unexpected emergencies, provide funds for major life events like a child’s education, or be the capital you need for that big kitchen renovation you've been dreaming of. As we'll explore later, it's a flexible resource you can tap into when you need it.

Ultimately, knowing your equity is about more than just numbers on a page. It’s about understanding the true value of your biggest investment and feeling empowered to plan for your family's future with confidence.

Calculating Your Home Equity in Manitoba

So, what exactly is home equity? Think of it as your true ownership stake in your property. It’s the part of your home you actually own, free and clear of what you owe the bank.

Figuring it out is surprisingly simple. There's no complex Wall Street algorithm, just one straightforward formula:

Current Market Value – Remaining Mortgage Balance = Your Home Equity

That final number is a powerful indicator of your financial health. It’s the value you’ve built, payment by payment, in one of your biggest assets.

Let's ground this in reality with a few examples from right here in our corner of Manitoba. Every homeowner's journey is different, and these scenarios show how equity can grow in different ways.

The Formula in Action Across Manitoba

We'll look at three common situations we see all the time.

Scenario 1: The Growing Family in Bridgwater, Winnipeg

A family put down roots in a new build in Bridgwater five years ago, buying for $550,000. The neighbourhood has been buzzing with development, and their home's value has climbed to $620,000. All the while, they’ve been chipping away at their mortgage, and now owe $440,000.

- Market Value: $620,000

- Mortgage Balance: $440,000

- Home Equity: $180,000 ($620,000 - $440,000)

In just five years, they've built a solid financial cushion thanks to both market appreciation and their own payments.

Scenario 2: The First-Time Buyer in Wolseley

Imagine a young professional who fell for a character home in Wolseley two years ago, buying it for $350,000. The market's been steady, and the home is now valued at $365,000. Since they're still early in their mortgage journey, their balance is around $330,000.

- Market Value: $365,000

- Mortgage Balance: $330,000

- Home Equity: $35,000 ($365,000 - $330,000)

Even with a shorter timeline, their equity is already taking shape. That initial stake is what gets the snowball rolling, growing faster as they pay down more principal and the home (hopefully) continues to appreciate.

Scenario 3: The Long-Time Homeowner in Steinbach

Now, picture a couple who bought their family home in Steinbach 20 years back for just $180,000. Today, after two decades of memories, home improvements, and community growth, their property is worth $450,000. They're nearing the finish line on their mortgage and owe only $40,000.

- Market Value: $450,000

- Mortgage Balance: $40,000

- Home Equity: $410,000 ($450,000 - $40,000)

This is the long game in action. Their discipline and patience have turned their home into a major asset, giving them incredible financial flexibility for retirement or whatever comes next.

A Quick Word on Affordability

It's worth noting how good we have it here. While our Manitoba market provides a stable path to building equity, the picture is wildly different in other places.

Take California, for example. Sky-high home prices and interest rates have sent monthly housing costs into the stratosphere—payments for a mid-tier home there have jumped by 82% since 2020. While that's created a ton of "paper wealth" for existing owners, it's made getting into the market a nightmare for new buyers.

This contrast really drives home the balanced and accessible wealth-building opportunity that homeownership in Manitoba represents.

Curious how different payment plans could accelerate your own equity growth? Play around with the numbers on our mortgage calculator to see for yourself.

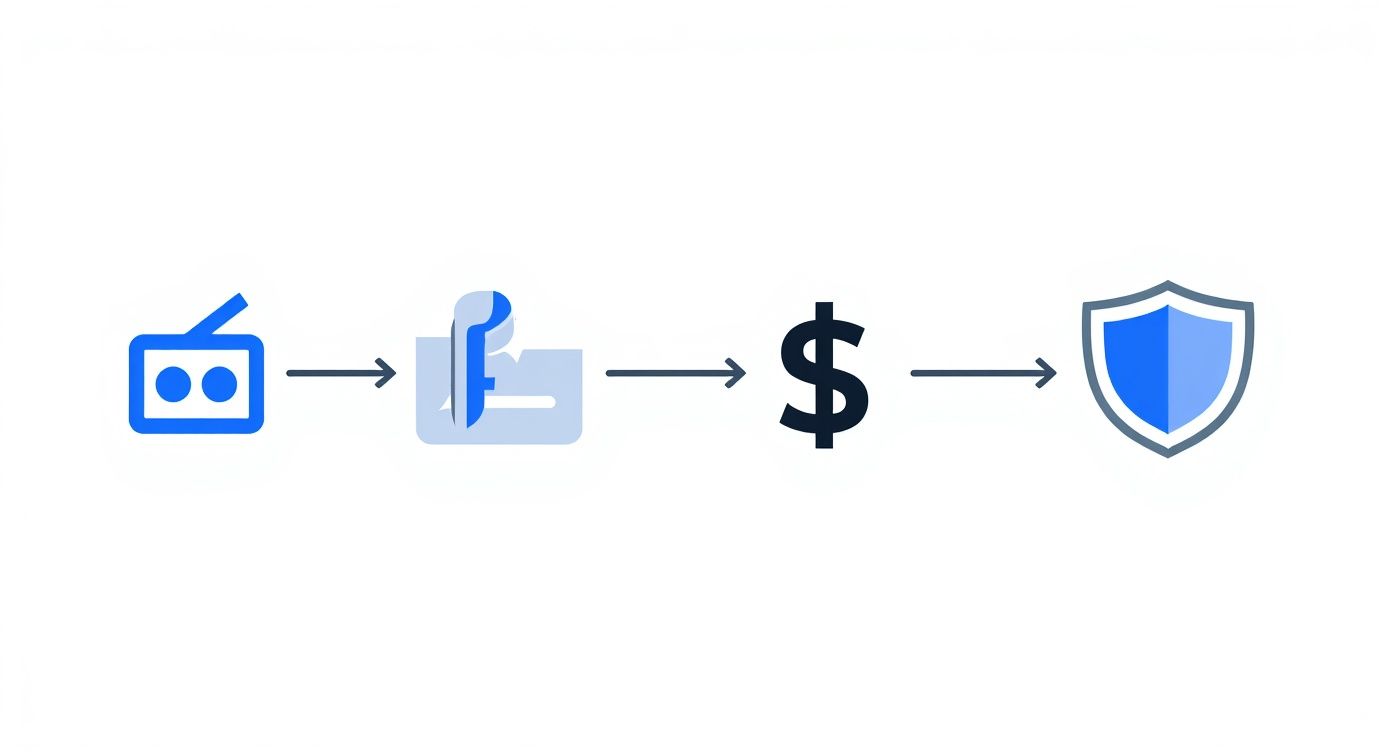

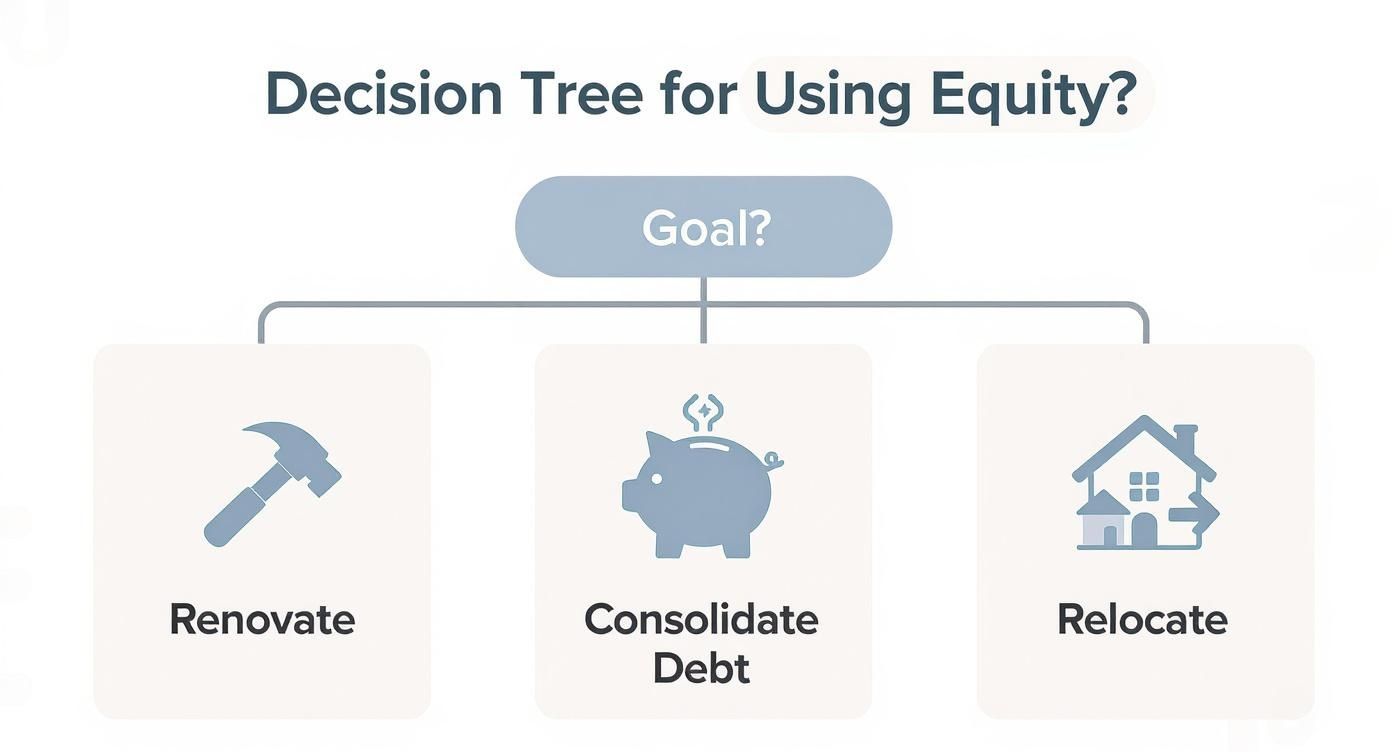

Three Smart Ways to Access Your Home Equity

So, you’ve got a handle on what home equity is and have a rough idea of how much you've built up. That leads to the big question: what can you actually do with it? Having equity in your home gives you some incredible financial flexibility, but tapping into it requires a clear strategy. For homeowners here in Manitoba, there are three main paths you can take to put that value to work.

Each method is built for a different purpose, and picking the right one comes down to your financial goals, your timeline, and how you feel about taking on new debt. Let's break down these options with some real-world Manitoba scenarios.

Using a Home Equity Line of Credit

Think of a Home Equity Line of Credit (HELOC) like a reusable credit account that’s secured by your house. Instead of getting a big cheque upfront, you’re approved for a specific credit limit—usually up to 80% of your home's appraised value, minus what you still owe on the mortgage. You can then draw from that fund whenever you need it, paying interest only on the amount you’ve actually used.

This makes a HELOC a fantastic tool for expenses that are ongoing or just plain unpredictable.

- Best for: Projects with fuzzy costs, like a major home renovation or covering a few years of tuition payments.

- Key Feature: You only borrow what you need, when you need it.

- Consideration: The interest rates are often variable, which means your payments could change over time.

For instance, let’s say you own a family cottage out at Falcon Lake that’s crying out for a new dock and a screened-in porch. The total cost is a bit of a question mark, and you want to tackle the projects in stages. A HELOC gives you the freedom to pay contractors as the work gets done, all without having to take out a massive loan from the get-go.

Pursuing a Cash-Out Refinance

A cash-out refinance works a little differently. With this option, you’re essentially replacing your current mortgage with a new, larger one. You then get the difference between the new loan amount and your old mortgage balance in a single, tax-free lump sum payment.

This approach is perfect for big, one-time expenses where you know the exact cost ahead of time. It's a powerful way to turn your home's equity into cash you can use right away.

A cash-out refinance is ideal for debt consolidation. If you have high-interest credit card debt or personal loans, you can use the funds from your refinance to pay them off, often consolidating everything into a single monthly payment at a much lower interest rate.

Picture a family in Steinbach who has racked up $30,000 in various high-interest debts. By doing a cash-out refinance, they could wipe those balances clean and roll that debt into their new mortgage. This move simplifies their finances and could save them thousands in interest payments down the road.

Selling Your Home to Unlock Full Equity

The third and most final way to get at your equity is to sell your property. When you sell, the money from the sale first goes to paying off your remaining mortgage balance and any closing costs. Whatever is left over is your realized equity—cash in your pocket that you can use for whatever life has in store for you next.

This is the ultimate way to access 100% of the value you've built up in your home.

- Best for: Major life changes like retiring, downsizing, or moving to a new city.

- Key Feature: It provides the maximum possible cash from your home's value.

- Consideration: It requires you to move and find a new place to live.

Think of a couple who has lived in their large River Heights home for 30 years and decides it’s time to downsize. By selling their long-time family home, they could unlock hundreds of thousands of dollars in equity. That provides a hefty nest egg to fund their retirement travels and buy a smaller, more manageable condo. Preparing their home for the market would be a crucial first step, and you can learn more in our guide on how to prepare your home for sale in Southeast Manitoba.

Comparing Your Home Equity Options

Choosing how to access your equity is a big decision, and seeing the options side-by-side can make it a lot clearer. Here’s a quick breakdown of how a HELOC, cash-out refinance, and selling your home stack up against each other.

| Method | How It Works | Best For | Key Consideration |

|---|---|---|---|

| HELOC | A revolving credit line you can draw from as needed. | Ongoing projects with variable costs (e.g., renovations, tuition). | Interest rates are often variable, so payments can change. |

| Cash-Out Refinance | Replace your mortgage with a new, larger one and get the difference in cash. | Large, one-time expenses with a known cost (e.g., debt consolidation). | You receive a lump sum, and your mortgage balance increases. |

| Selling Your Home | Sell the property and receive the net proceeds after paying off the mortgage. | Major life transitions (e.g., retirement, relocation, downsizing). | You unlock 100% of your equity but must move out. |

Each path has its place, and the best choice really boils down to what you're trying to accomplish financially.

While homeowners across Canada have seen fantastic equity growth, it's always smart to keep an eye on broader market trends. Recent analyses show that while average home equity is still near record highs nationally, some markets are seeing that growth slow down due to rising mortgage balances. For example, in 2025, the number of homes in a negative equity position in the U.S. actually increased by 18% year-over-year. This just highlights why it's so important to weigh your options carefully before making a move.

Key Risks to Consider Before Tapping Your Equity

Using your home equity can feel like unlocking a secret financial level-up, but it’s a move that needs to be made with your eyes wide open. Your home isn't just an asset on a spreadsheet; it's the heart of your family's life. Before you cash in that hard-earned equity, let’s walk through the potential risks.

Honestly, understanding the downsides is just as important as daydreaming about the benefits. When you use your home as a financial tool, you're taking on some serious responsibilities. Being ready for every what-if scenario is the best way to make sure you’re making a smart choice that protects your future.

The Danger of Over-Leveraging

One of the biggest pitfalls is becoming over-leveraged. It’s a formal-sounding term for a very real problem: you’ve simply borrowed too much against your home. This can quickly lead to that stressful "house rich, cash poor" feeling.

Sure, you might have a stunning new kitchen or a paid-off credit card, but if your monthly payments are suddenly eating up your entire budget, you've traded one problem for another. High loan payments can suffocate your cash flow, leaving no breathing room for emergencies, savings, or just plain living. A sudden job loss or an unexpected medical bill—things that were once manageable—could put you in danger of missing payments.

This infographic can help you visualize the different paths people take when thinking about their equity.

As you can see, every option starts with a specific goal, which really drives home the point: you need to match the financial tool to the job you want it to do.

The Impact of Rising Interest Rates

If you're leaning towards a Home Equity Line of Credit (HELOC), you're stepping into the world of variable interest rates. That low introductory rate can look very attractive, but remember, it’s tied to the Bank of Canada's prime rate, which can—and does—change.

You don’t have to look far in the news to see headlines from sources like the CBC or Globe and Mail discussing the Bank of Canada's interest rate hikes. When the prime rate goes up, your HELOC payment will follow suit, sometimes in a big way.

A 1% increase in the prime rate on a $100,000 HELOC balance means you’re paying an extra $1,000 a year in interest. That kind of jump can be a real shock if you haven't planned for it.

This unpredictability makes budgeting a challenge. A payment that felt comfortable one month could suddenly stretch your finances to the breaking point, forcing you to make cuts elsewhere.

The Risk of a Market Downturn

The real estate market, even right here in Manitoba, doesn't have a one-way ticket up. We've had a great run of growth, but markets are cyclical. They can cool off or even dip, and that introduces the risk of negative equity—or what people grimly call being "underwater."

This is what happens when your home's market value sinks below the total amount you owe on the mortgage plus your equity loans.

Let's paint a picture:

- You buy a home in Winnipeg for $400,000.

- Your mortgage balance is $300,000, and you take out a $50,000 HELOC for a project.

- You now owe $350,000 in total.

- Then, a market correction hits, and your home’s value drops to $340,000.

Just like that, you owe $10,000 more than your house is worth. This puts you in a real bind. Selling means you'd have to bring cash to the closing, and getting a new mortgage or refinancing is pretty much off the table. While markets typically recover over time, being stuck in a home with negative equity is a stressful and financially vulnerable place to be. It’s a potential outcome you absolutely need to consider before signing on that dotted line.

Ready to Build Your Home Equity Faster? Here's How

Waiting for your home equity to grow passively is one way to do it, but why wait? You can take control and actively build your financial stake in your home. Think of it less like watching grass grow and more like tending to a garden—with a little effort, you can see incredible results.

These aren't complex financial schemes. They're straightforward, proven strategies that put you firmly in the driver's seat of your financial future. Let's dig into five powerful ways you can speed up your equity growth and turn your property into an even more valuable asset.

Switch to Accelerated Bi-Weekly Payments

This might be the simplest, most effective trick in the book. Most people make 12 standard mortgage payments a year. But if you switch to an accelerated bi-weekly plan, you'll make a payment every two weeks instead.

That adds up to 26 payments a year. Since each one is just half of your usual monthly amount, you sneak in one full extra mortgage payment annually without really feeling the pinch.

That extra payment goes straight to your principal, not the interest. The result? You can shave years off your mortgage and save a bundle on interest over the life of the loan. It’s a classic set-it-and-forget-it strategy for building wealth.

Make Strategic Lump-Sum Contributions

Ever get a work bonus, a nice tax refund, or a small inheritance? Before you splurge, think about putting it directly onto your mortgage principal. Even a one-time payment can make a surprisingly big difference down the road.

For instance, dropping a $5,000 lump sum on a $400,000 mortgage with a 5% interest rate could save you more than $12,000 in interest and knock several months off your mortgage term.

Quick heads-up: Always check your mortgage agreement for prepayment rules. Most Canadian lenders let you pay off a certain percentage of your original loan (usually 10-20%) each year without any penalties.

Invest in High-ROI Home Improvements

Not all renovations are created equal, especially when it comes to boosting your home’s value. The secret is to focus on projects with a high return on investment (ROI). These smart upgrades increase your home's market value, which directly grows the equity you hold.

Here in Manitoba, some updates almost always add value and catch a buyer's eye:

- Kitchen Remodels: An updated kitchen is a huge selling point. Even smaller updates—new countertops, modern hardware, or a fresh backsplash in a Charleswood home—can seriously lift its value.

- Bathroom Renovations: Nobody likes a dated bathroom. A modern vanity, new tile, or energy-efficient fixtures can make a world of difference.

- Enhancing Curb Appeal: You only get one chance to make a first impression. Good landscaping, a new front door, or fresh exterior paint helps your property stand out in a competitive neighbourhood like Sage Creek, attracting better offers.

- Energy-Efficient Upgrades: With our winters, things like new windows, better insulation, or a high-efficiency furnace are practical features that buyers love and can increase your home's market value.

These improvements make your home a better place to live today while also beefing up the "market value" side of your equity equation.

The Power of Market Appreciation

You can’t control the real estate market, but you can certainly benefit from it. Your equity doesn't just grow from what you pay down; it also grows as property values naturally rise over time. This is where living in a strong, stable market really pays off.

While Manitoba's market is known for its steady growth, other regions show just how powerful this effect can be. Take California, where long-term price appreciation has become a massive source of wealth for homeowners. As of early 2025, the median home price there soared to around $884,350. That kind of surge directly translates into more equity, showing how market forces can be a powerful partner in wealth creation. You can see more on how different markets behave in this California housing market report.

Stay Put and Let Time Do the Work

Finally, one of the most underrated strategies is also the simplest: just stay in your home longer. During the first few years of a mortgage, most of your payment goes toward interest, not the principal. It can feel like you're barely making a dent.

But as you get further into your loan term, that balance starts to flip. More and more of each payment chips away at what you owe, which really starts to accelerate your equity growth. In real estate, sometimes patience is the most powerful tool you have.

Finding Your Home's True Value

We’ve spent this whole guide talking about home equity, and for good reason—it’s one of the most powerful financial tools you own. Think of it as a quiet wealth-builder, growing in the background with every mortgage payment you make and every time our local Manitoba market ticks upward.

But whether you’re thinking about a HELOC, a renovation, or selling your home, every single strategy depends on one thing: knowing what your home is actually worth today. Anything less is just a guess.

From a Concept to a Number You Can Use

Getting a real, accurate valuation turns "home equity" from a vague idea into a hard number. It’s the number you’ll use to calculate exactly what you have to work with, giving you the confidence to plan your next move. It’s the key that unlocks all the potential sitting inside your property.

That's where we come in. Here at The Elias Group, we’re rooted in the Steinbach, Winnipeg, and Southeast Manitoba communities. Our whole mission is to give you that clarity—to help you see the real value you’ve worked so hard to build. We believe an informed homeowner is an empowered one.

Your home is so much more than an address; it’s a massive investment. A precise, up-to-date valuation makes sure you’re not leaving money on the table, no matter what you decide to do next.

We’ve made it simple to get started, with no strings attached. Our free home valuation tool digs into current market data to give you a detailed and accurate picture of your home’s worth. You’ll finally see the equity you can access, clear as day.

Take that first step. Find out what your home is worth with our free, no-obligation home valuation and start building your future on solid ground.

Common Questions About Home Equity in Manitoba

Even after you've got a handle on the basics, it's natural to have more questions about how home equity works in the real world here in Manitoba. This is where we clear up some of the common things people wonder about, giving you straight answers so you can move forward with confidence.

Let's dive into the questions we hear most often from homeowners right here in our communities.

How Long Does It Take to Build a Good Chunk of Equity?

This is one of the first questions on everyone's mind, but the answer isn't a simple number. Building a meaningful amount of home equity in a market like Winnipeg or Steinbach is a bit like a recipe—it depends on a few key ingredients working together. Think of it as a mix of your down payment size, your mortgage term, and how our local real estate market is performing.

Generally, most homeowners start to feel like they've made real progress after the 5 to 7 year mark. By then, your regular mortgage payments have made a noticeable dent in what you originally owed. Just as important, that's often enough time for the market to do its thing, giving your home's value a nice lift and your equity a serious boost. For example, steady market growth like we've seen reported locally can add significant value on top of the mortgage you've paid down.

Can My Home Equity Actually Go Down?

Yes, it absolutely can. This happens if your home's market value drops to less than what you still owe on your mortgage. This situation has a name: negative equity, though you'll often hear people say they're "underwater" on their loan.

Being underwater is a risk in any real estate market, particularly after a period of fast-rising prices is followed by a market correction. It can make it incredibly difficult to sell or refinance your home without having to pay out of pocket just to close the deal.

While the Manitoba market has shown some fantastic stability over the years, no market is bulletproof. A regional economic slowdown or a sharp rise in interest rates could cool buyer demand, causing property values to dip. This really highlights why it’s so important to think of your home as a long-term investment, not a get-rich-quick scheme.

Should I Use a HELOC or a Personal Loan for Renovations?

When you're ready to fund that big home reno, you'll likely run into two popular options: a Home Equity Line of Credit (HELOC) or a personal loan. They can both get the job done, but they're built for different situations.

-

A HELOC is usually the better fit for large, ongoing projects where costs can be a bit unpredictable—think of a full kitchen gut job in your St. Vital bungalow. Because it's secured by your home, a HELOC typically comes with a lower interest rate. You can also draw funds as you need them, paying interest only on the amount you've actually used.

-

A personal loan is an unsecured loan, which just means it isn’t tied to your house. This makes it a solid choice for smaller, well-defined projects where you know the exact cost upfront, like replacing the windows on your Winkler home. The interest rate might be a bit higher than a HELOC's, but the application process is often simpler and you aren't putting your home on the line as collateral.

At the end of the day, the right choice really boils down to the scale of your project and your personal comfort level with using your home to back the debt.

Figuring out your home equity options starts with knowing your numbers. At The Elias Group, we help homeowners in Steinbach, Winnipeg, and across Southeast Manitoba get the clarity they need to make smart financial decisions.

Use our free, no-obligation home valuation tool to get a real sense of your property's current market value and find out just how much equity you've built. Find out what your home is worth today.

Categories

Recent Posts